by John | Jul 14, 2016 | Business, General, Legal

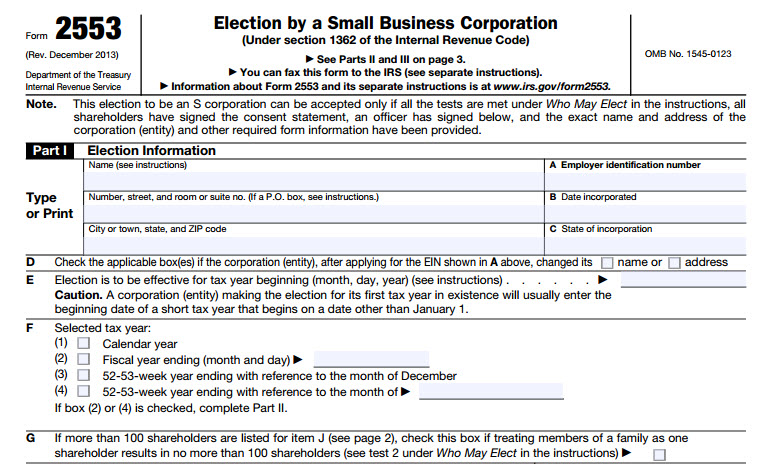

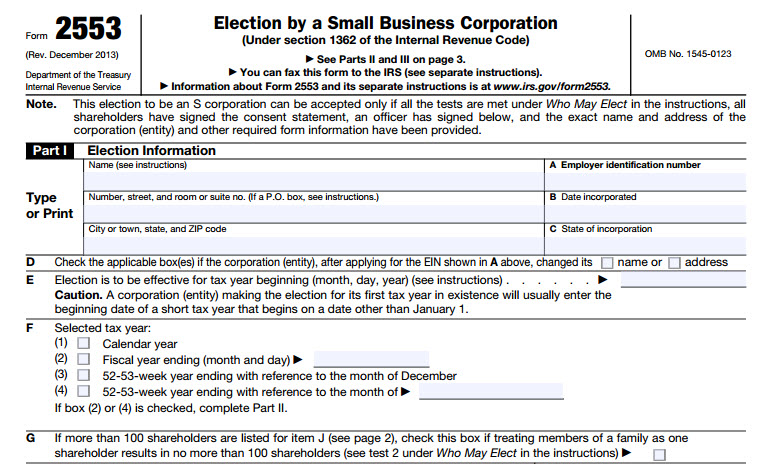

My introduction to the two primary kinds of commercial (or profit-making) corporate structures in the U.S.: C- and S-corporations. What’s the difference? How shareholders are taxed. (Prosperity Hint: When you enter the world of legal structures, you will discover you have a lot more flexibility when it comes to the taxes you pay!)

*******

Last time, I described my introduction to the idea of legal structures (and, particularly, the corporation). Based on what we learned, we agreed that, most definitely, we wanted to incorporate our business.

So we did. And what I mentioned in that post pretty much summarizes Sarita’s and my experience—and my knowledge—of legal structures for the next six years or so. (more…)

by John | Jul 13, 2016 | Business, General, Legal

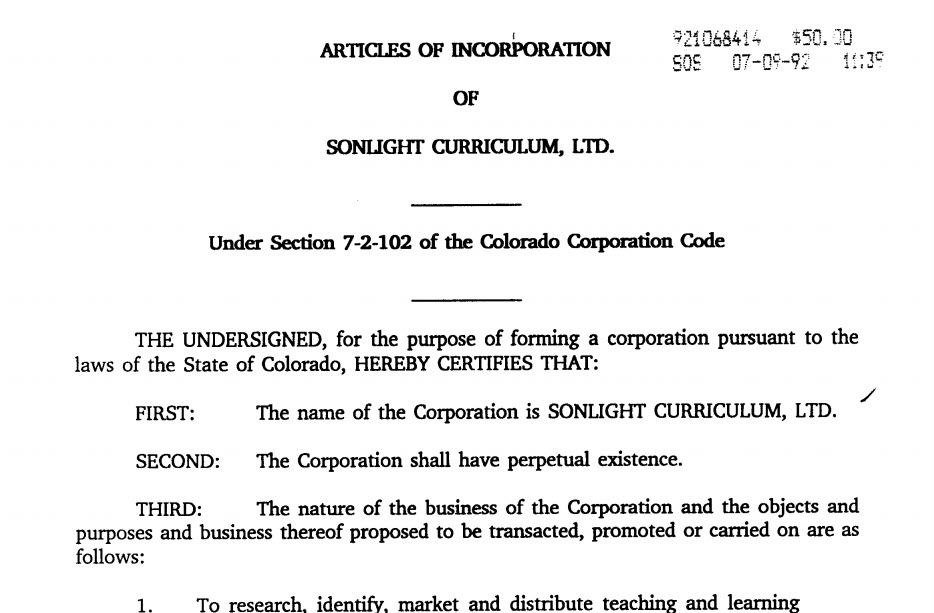

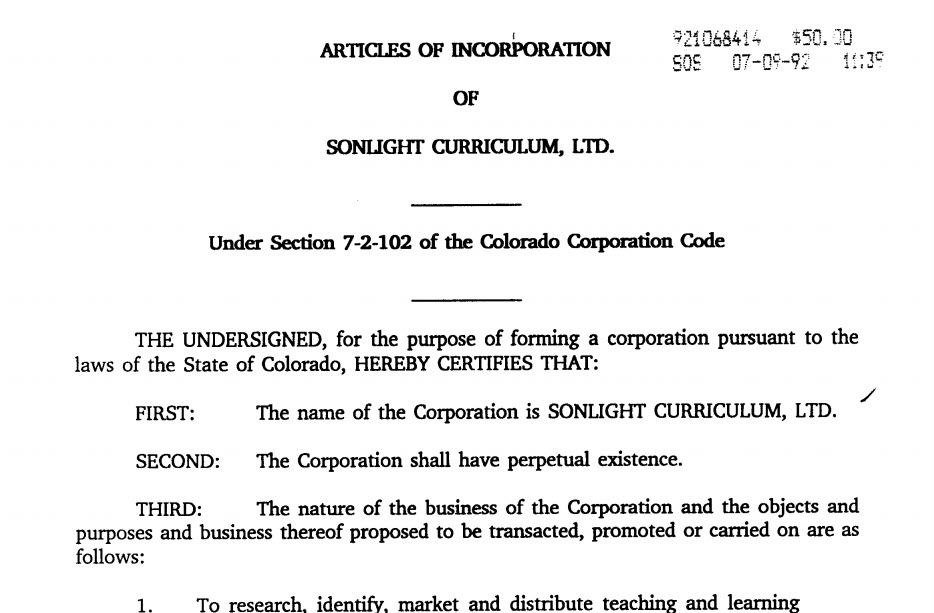

Sonlight Curriculum, Ltd.’s original Articles of Incorporation: How Sonlight Curriculum became a legal structure independent of a human being . . . and how the human beings who had created Sonlight Curriculum gained legal independence from the business!

It was 1992. We were just at the point where we were going to hire our first employee and Pete Smit urged me to call a certain company to see if maybe we wanted to engage in employee leasing rather than (all we knew about at the time) actually hiring someone.

He had given me the name of the leasing company. But, when I looked them up, it turned out (what I didn’t notice) that there was another company with virtually the same name right in front of theirs in the phone book. And I called the wrong number.

As it turned out, that was a wonderful mistake I made! (more…)

by John | Jul 12, 2016 | General, Legal

A short while ago, I mentioned bumping into W. G. Hill’s book back around 1990, PT: The Perpetual Traveler, the Perpetual Tourist. The Possibility Thinker.

I said that the first, most basic concept Hill taught that grabbed my attention was this: to get outside your box. Try always to see the world from a larger perspective. There is more out there than you can imagine.

Today—not because I have totally “bought” the theory, but because it has deeply influenced how I view the world and because sometimes you need to hear a concept several times over from different perspectives—I want to summarize the concept for which Hill (and, before him, Harry Schultz) was best known.

It’s the idea of structuring your life so that you are beholden to no single governmental power.

Schultz and, then, after him, Hill, spoke of multiple “flags” (a flag being a symbol of one’s presence and allegiance). (more…)

by John | Jul 11, 2016 | 1-Growth, General, Investing

When last I played musical chairs with other adults, we were nowhere near as nonchalant as these kids. We slithered from chair to chair with our butts down as long as possible. We wanted to be in mid-air only for the briefest period of time. So where do you want your butt to be when your personal financial music stops?

I was listening to the podcast of two of my favorite financial commentators several weeks ago when they made an offhand comment that slowly painted a picture in my mind.

They said something about there being two types of investors in the world. Some people buy assets to produce money so that they can buy more assets. Others amass money so they can buy assets that they hope will produce more money.

As I thought about the comment, it struck me that they were describing a musical chairs kind of situation. And I formulated a question: As you approach investing, do you think of money as being the “chair” . . . or cash-flowing assets as being the “chair”? (more…)

by John | Jul 9, 2016 | 1-Growth, General, Investing

Where I’d like to see our company’s 401(k) go.

I used to think our company’s 401(k) program was a great deal . . . for our employees as well as our company. Now I’m convinced it is a raw deal. Especially for our employees. (Though I have serious reservations for the company as well. But that’s for another time.)

Sadly, so far, I’ve been unable to convince the management team to get something better. And, I’m afraid, too many of our employees are enamored of the program as well. (I’ve been told: “If you didn’t have a 401(k) plan, I wouldn’t have come.” —And this from a financial person who ought to know better!)

So let me tell you what I have learned in the last couple of years that has turned me so strongly against the standard, government-approved, defined contribution plans. . . . (more…)

by John | Jul 8, 2016 | Cash Management, General, Success

I don’t know when I first bumped into the concept. Probably sometime in my 30s. I called it “The Party Tithe”: 10% of my income totally for fun.

I got it from Deuteronomy 14:22-26 in the Bible. (more…)

by John | Jul 6, 2016 | General, Success

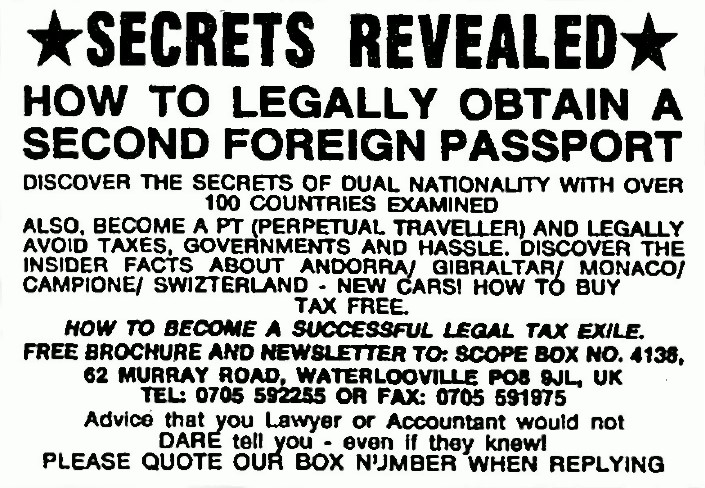

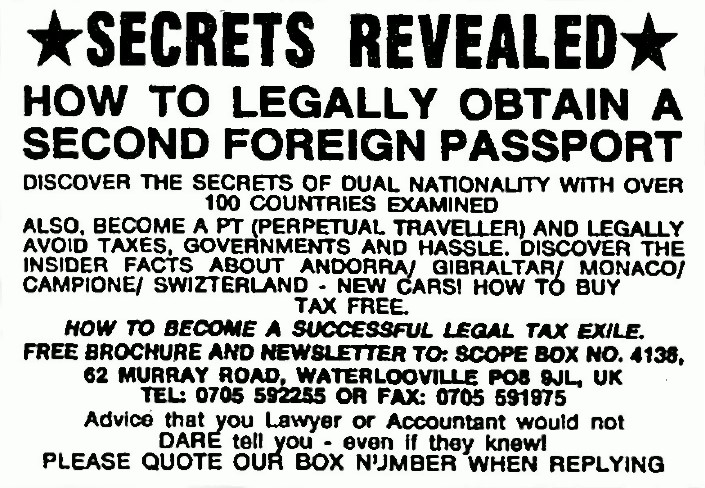

A vintage 1994 ad from Scope Books Ltd. that appeared in The Times of London.

It must have been sometime in 1989 or 1990. I saw an ad at least somewhat similar to what I have reproduced above. And it grabbed my eye.

At the time, I had no money. But I had always been intrigued by “what else” is out there. (more…)

by John | Jul 5, 2016 | 1-Growth, 2-Income, General, Success

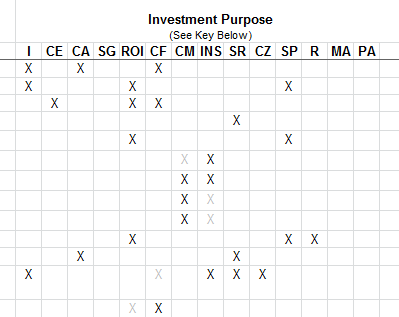

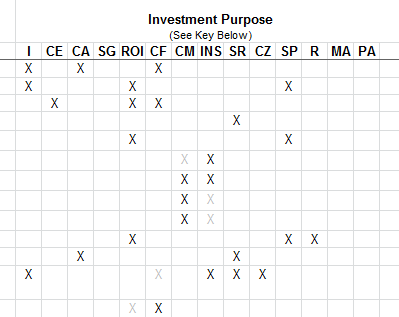

One of my advisors suggested I list the reasons why Sarita and I wanted to put money into the various investments we had already purchased or that we were thinking we wanted to buy. “Maybe create a matrix that indicates your purposes for each asset,” he suggested.

I followed his counsel and found the exercise helpful and eye-opening.

(more…)

by John | Jul 4, 2016 | 3-Legacy, Charity, General

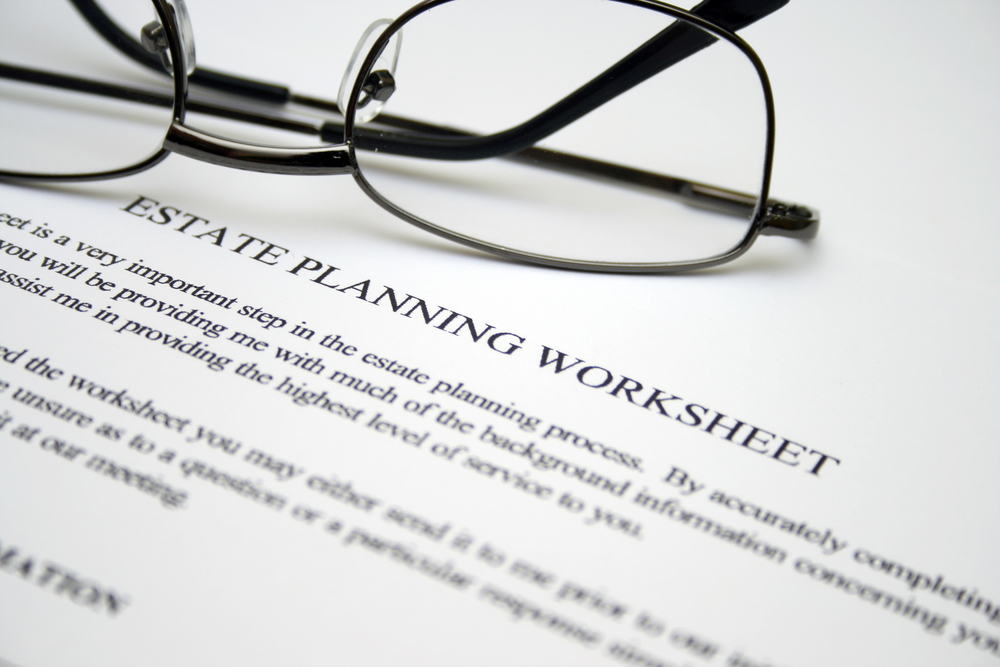

Estate plans are vital. And everyone should have one. Just be sure you’re covering your bases. My experience says even highly competent estate planning attorney will fail to ask important questions. So you need to ask some of these questions yourself . . . and be prepared to direct your attorney in ways he or she might not normally think to go or, perhaps, never has gone before!

(more…)

by John | Jul 2, 2016 | Success

I have run into the following questions more often than I can remember. And, most of the time, I have found them rather frustrating. How about you?

- Where do you want to be (financially) in five years? 10 years? 20 years? When you retire? Etc. (???)

- What are you aiming for in your investments: Preservation of capital? Income? Growth? Profits? Speculation? Hedging? . . .

- You’re about to buy a stock. The “best” advisors say you should know your exit strategy. Okay. So when will you know it’s time to sell?

- What’s your number (when you will know you have enough to retire)?

- Where do you want your money to go when you die?

And so forth.

Why are these questions so frustrating? Because—at least for me—I have a hard time pinning myself down! So much “depends”!

Worse, (more…)

Recent Comments