My introduction to the two primary kinds of commercial (or profit-making) corporate structures in the U.S.: C- and S-corporations. What’s the difference? How shareholders are taxed. (Prosperity Hint: When you enter the world of legal structures, you will discover you have a lot more flexibility when it comes to the taxes you pay!)

*******

Last time, I described my introduction to the idea of legal structures (and, particularly, the corporation). Based on what we learned, we agreed that, most definitely, we wanted to incorporate our business.

So we did. And what I mentioned in that post pretty much summarizes Sarita’s and my experience—and my knowledge—of legal structures for the next six years or so.

I don’t have records from back then, but I expect it must have been in 1997, Blaine died. In fact, he died just a day before we had agreed to meet so he could go over our completed tax returns (both personal and corporate).

Talk about shocking! I had just spoken with him that morning to confirm our appointment. And then he didn’t show up.

Happily, we found a new accountant rather quickly, but we had to start the tax return process all over again . . . primarily because the new accountant wasn’t going to sign his name to a return prepared by someone with whose work he was wholly unfamiliar!

It was sometime in late ’97 or early ’98 that Lance, the new accountant, asked about our decision to incorporate as a C-corporation.

Something in the way he asked the question alerted me to the fact that we could have chosen to incorporate as something other than a C-corporation.

And so I learned about . . .

S-Corporations

“What’s an S-corporation?” I’m sure I must have asked. “And how is it different from a C-corporation?”

Basic explanation: a C-corporation is how all the big companies are structured. They have no legal limits concerning shares or shareholders. They pay taxes on their profits and then pay dividends to their shareholders (as and when they want) in order to put those profits into the hands of their shareholders. Until the corporation makes a dividend payment, the shareholders pay no taxes.

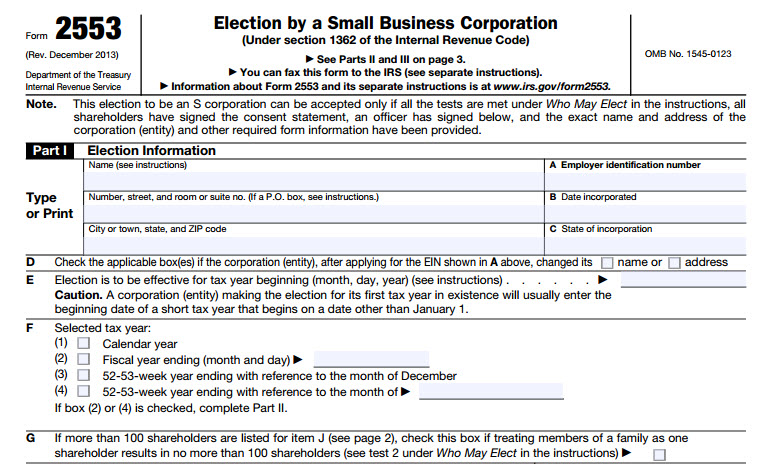

All corporations were C-corporations until 1958, when the U.S. Congress adopted certain provisions in the tax code that permitted small businesses (the “S” in S-corporation refers to the S in “Small Business”) to handle their taxes in a way not permitted to larger C-corporations.

So it’s important, first, to understand what corporations, specifically, can apply to be treated as S- (or “small”) corporations for the purposes of the tax code.

The Primary Characteristics of an S-Corporation

S-corps have legal limits on the number of shareholders they can have (at this time, they can have up to 100) . . . and on who (or what) can be shareholders.

Individuals can own S-corp stock; so, too, can trusts that have individuals as beneficiaries. A multi-shareholder S-corporation can own shares of another S-corporation. (In that case, the owned S-corp is called a QSSS—a Qualified Subchapter S Subsidiary.) Estates of people who owned shares in the corporation before they died can continue to hold S-corp stock while the estate is going through probate. . . .

Not to get too far into the weeds, here, but I think it’s interesting: for an S-corporation to become a QSSS, all of its shares must be owned by another S-corporation and only that S-corporation. Legally, a QSSS is just like any other S-corp: It is legally distinct from its owner, so the “parent” S-corporation has no liability for the debts or contractual obligations of the QSSS, and the “parent” can’t lose more than it has invested in the QSSS.

But the really big reason why you might want to own an S- rather than a C-corporation? Taxes.

What are the Primary Differences in How S-Corps are Treated Compared to How C-Corps are Treated?

I mentioned that the C-corporation has to pay taxes on its profits before it passes any profits to its shareholders in the form of dividends. With S-corporations, for tax purposes, it is as if the corporations don’t exist. Any profits (or losses) go directly to the “bottom line” of the individual shareholders.

Lance described the C-corporation tax set-up as “double-taxation”: first at the corporate level, then at the individual level. With an S-corporation, you pay taxes just once: at the individual level.

Even when there are one or more intermediate S-corporations between a QSSS and an individual shareholder: it’s as if none of the intermediate S-corporations exist. They are completely transparent. All the profits and all the losses flow directly into the shareholders’ personal tax returns.

*******

“So why would Blaine and our attorney have recommended we create a C-corporation?” I asked.

If I recall accurately, Lance replied something to the effect that, “It was a good thing to create a C-corporation because, for various reasons (having to do with how one accounts for profits and losses and “reasonable compensation,” etc.), we have been able to keep you from having to pay any corporate income tax. Meanwhile, you were able to enjoy certain tax write-offs (for medical expenses) that you wouldn’t have if you had taken the S-corp election.

“HOWEVER, that time is coming to a close. If you want to maximize your tax benefits, 1997 will have to be your last year as a C-corp.”

So in 1998, Sonlight Curriculum, Ltd. became an S-corporation.

Recent Comments