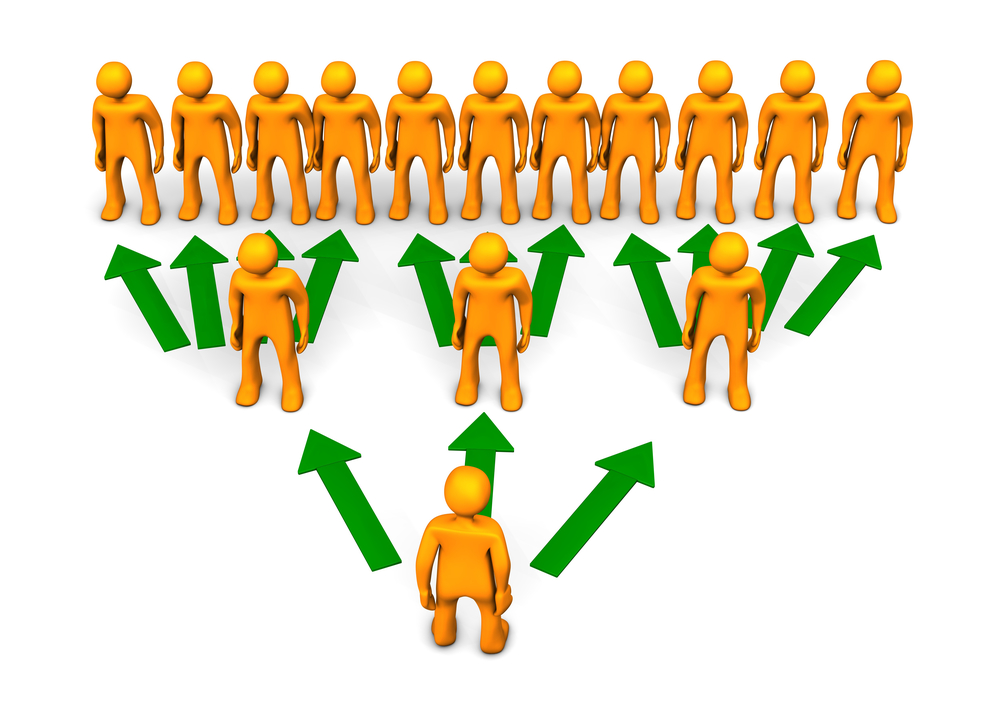

A Ponzi scheme–like the U.S. government’s Social Security program–will only last as long as there are enough fools to cover the payments promised to those who came before. The question is: when and how will the fraud finally come to light? And what will happen when Americans finally acknowledge it for what it is?

AARP’s “Take a Stand” Program

Jo Ann Jenkins, CEO of the American Association of Retired Persons (AARP) writes, “Social Security is a promise we’ve been able to keep for generations, thanks to the courage of many of our nation’s leaders.” Fascinating sentence, that.

I am intrigued most especially by the reference to “we”—that “we’ve been able to keep” some “promise.” Who is this “we”?

And the idea of “courage” on the part of “our nation’s leaders.” –Really?

Jenkins attempts to explain herself:

The struggle to enact and improve Social Security took the leadership of Presidents Franklin D. Roosevelt, who started the program, and Ronald Reagan, whose bipartisan efforts saved the program from fiscal ruin in the 1980s. They stood up to critics, bridged political divides, and fought off constitutional challenges to protect the retirement security of the middle class and help keep tens of millions of Americans and their families financially resilient.

Now, she says, presumptive political leaders need to “tell all Americans how they’ll update Social Security . . . [to] keep [it] strong. . . . That’s why AARP [has created its “Take a Stand” program to press] the [current presidential] candidates to spell out their plans to keep Social Security’s promise alive for our children and grandchildren.”

Stirring words. Too bad they are so out of touch with reality.

If you are hoping to be Ready2Prosper in your older years, you would do well to pay attention.

The United States’ Great Ponzi Scheme

I remember the shock. It was sometime in the mid-1980s. I was reading Dr. Gary North’s 12 Deadly Negatrends. I don’t remember what else the book discussed, but the chapter on the U.S. government’s Social Security scheme opened my eyes.

The U.S. federal government’s Social Security “fund” hasn’t invested anything in profit-making enterprise. It doesn’t have actual dollars and cents sitting somewhere waiting to be paid out to the hardworking Americans who believe they have been “investing” in the program (and whose employers have matched their “investments” dollar-for-dollar throughout their careers).

Even though the federal government speaks of Social Security as if it were some kind of “insurance,” it is, most definitely, not insurance, either.

Nope. Social Security is and always has been a Ponzi Scheme. Past “contributors” get paid out of funds “contributed” by those who are currently paying into the system. Oh. And let us not forget the funds they receive from the millions of impoverished citizens of foreign countries whose governments keep buying U.S. government bonds.

How the Scheme Works

As North explains (the following section is largely dependent on pp. 30-32 in his book):

The U.S. government, in testimony before the Supreme Court in 1937, had to admit that Social Security is simply a tax. “It does not constitute a plan for compulsory insurance within the accepted meaning of the term ‘insurance,’” the government said in Helvering v. Davis (1937). Indeed, in that case the government admitted that Social Security taxes were “true taxes, the purpose being simply to raise revenue. No compliance with any scheme or Federal regulation is involved. The proceeds are paid, unrestricted, into the Treasury as Internal Revenue collections, available for the general support of the government.”

Catch that? As far as the federal government is concerned, it doesn’t “owe” you anything.

Of course, those responsible for this Ponzi Scheme aren’t particularly interested in pulling the blinders off your eyes any sooner than necessary. But I’m writing Ready2Prosper primarily for that very purpose: to help you see reality for what it is.

In case Helvering v. Davis isn’t good enough for you, let’s consider another Supreme Court case: Flemming v. Nestor (1960).

A woman’s husband was deported. Next thing she knew, she was no longer receiving Social Security payments. “Hey! But he paid into the system for years! Don’t I have a right to these funds?”

Her case went all the way to the Supreme Court.

In its brief to the Court, the U.S. Department of Justice spoke forthrightly:

The OASI [Old-Age and Survivors Insurance] program is in no sense a federally administered “insurance program” under which each worker pays premiums over the years and acquires at retirement an indefeasible right to receive for life a fixed monthly benefit. . . .

And in its decision, the Court wrote:

To engraft upon the Social Security system a concept of “accrued property rights” would deprive it of its flexibility and boldness in adjustment to ever-changing conditions. . . .

You (or your husband) “invested” in or “contributed” to Social Security? Thanks. But it grants you no rights of any kind.

The Social Security Administration talks about the program as if it’s insurance, but that’s not what it is at all. Never has been and never will be.

The politicians in Washington have always “borrowed” funds set aside in the program. They use them to fund current expenses elsewhere in the federal government’s general budget. All current benefit recipients receive payments not as a result of returns on investment, but strictly as a result of the tax-extracting capability of the federal government from current (and, hopefully, future) tax payers.

I.e., if you’re hoping to receive Social Security “benefits,” they will come from your children and grandchildren. . . . Or they won’t come at all.

What Can’t Be Paid Won’t Be Paid

Laurence Kotlikoff noted back in 2011 (in The Clash of Generations) that the federal government had made promises—at that time—that were (again, at that time) worth over $200 trillion. It had promised to pay $200 trillion more than it had any idea how to pay. These were (and are) the so-called “unfunded liabilities.”

Michael Hudson notes (repeatedly, in books like Killing the Host: How Financial Parasites and Debt Bondage Destroy the Global Economy; and The Bubble and Beyond: Fictitious Capital, Debt Deflation and Global Crisis): debts that can’t be paid won’t be paid. The only question, says Hudson, is how the payment default will manifest itself.

Will it be via currency whose value goes to virtually nothing (à la Venezuela and Zimbabwe, today; or Argentina yesterday; or . . . well, you probably don’t need a list)?

Or through outright repudiation? . . .

And what happens in the meantime and as a result?

- Mere civil unrest . . . because those who believed the government’s impossible promises are angry that the government failed to keep them?

- World war . . . because the citizens and governments whose hard-earned savings were never returned by the indebted government figure they will take, by force, what they are convinced is rightfully theirs? (Imagine if American creditors loaned a trillion or two dollars to a foreign government, and the government repudiated its debates. Will the U.S. sit idly by and say, “Let them take it”?) . . .

Key “Lesson” for Today

Social Security is a Ponzi Scheme. And, as all Ponzi Schemes, it will eventually collapse. Plan to create your own, personal “social security” fund . . . that contains real assets.

For more on this subject

- ShadowStats.com’s Alternate Inflation Charts.

- Addison Wiggin’s Why You Shouldn’t Trust the Core CPI Numbers (December 15, 2010).

- Federal Government’s Social Security Administration Cost-of-Living Adjustment (COLA) page.

- The Grandfather Economic Report – Inflation Report (April 2012).

- The Grandfather Economic Report – Government Trust Fund and Deficit/Surplus Report (April 2011).

Worthwhile quote from the Trust Fund page:

Each year nearly every congress-person in both parties claims they want to save social security.

But every year they allow every penny of paid-in surpluses to the trust fund to be spent on other stuff.

The total amount siphoned-off from the Social Security Trust Fund [as of the end of 2010] is $2.4 Trillion, with an additional 2 Trillion siphoned from other trust funds, with zero plan to pay anything back to support future retirees.

Trust fund surplus siphoning continues to help camouflage government spending. So budget surpluses can be claimed when, instead, huge deficits were created. Or smaller deficits can be claimed than [are] really the case. . . .

Using trust fund surpluses to [pay] for other stuff is equivalent to a son siphon[ing]-off surpluses in his mother’s retirement account and us[ing] same to pay for a world cruise or pay down his own credit card debt. [He] then gives her non-marketable IOUs. [He has] zero pay-back plan[s], and instead of paying interest in cash (as he would have to do to a credit card company), he will just slip in a few more IOUs to her account.

Recent Comments