by John | Apr 1, 2017 | 3-Legacy, Cash Management, Charity, Family Banking, Golden Years/End of Life, Saving, Success

“Many high-net-worth investors ignore one of the most powerful financial-planning tools available to them: Social Security,” writes Ash Ashluwalia in this past Monday’s Wall Street Journal.

He caught my attention. I’ve been assuming the system’s demise–and seeking to make alternative plans–since the mid-1980s, when I first learned from Dr. Gary North about how the program is really a Ponzi scheme and is going to fail, one way or another.

Dr. North pointed to comments by then-Sen. William Proxmire during a 1976 hearing. I have bolded the most relevant part: (more…)

by John | Jul 8, 2016 | Cash Management, General, Success

I don’t know when I first bumped into the concept. Probably sometime in my 30s. I called it “The Party Tithe”: 10% of my income totally for fun.

I got it from Deuteronomy 14:22-26 in the Bible. (more…)

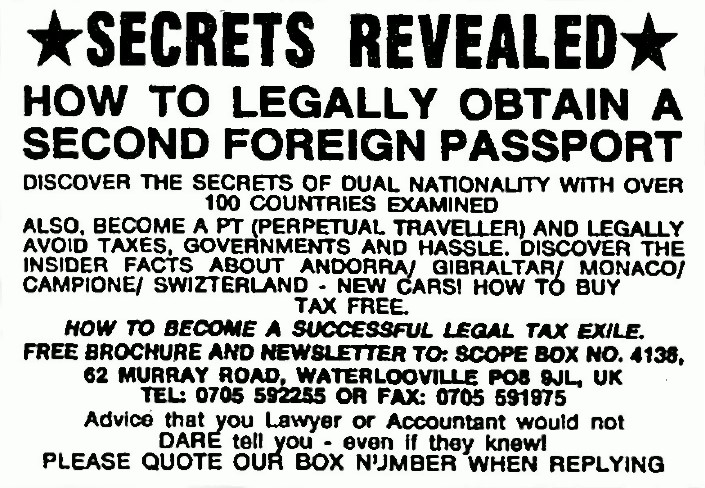

by John | Jul 6, 2016 | General, Success

A vintage 1994 ad from Scope Books Ltd. that appeared in The Times of London.

It must have been sometime in 1989 or 1990. I saw an ad at least somewhat similar to what I have reproduced above. And it grabbed my eye.

At the time, I had no money. But I had always been intrigued by “what else” is out there. (more…)

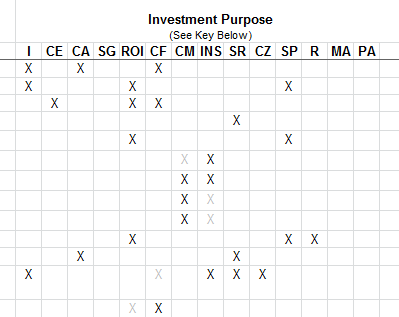

by John | Jul 5, 2016 | 1-Growth, 2-Income, General, Success

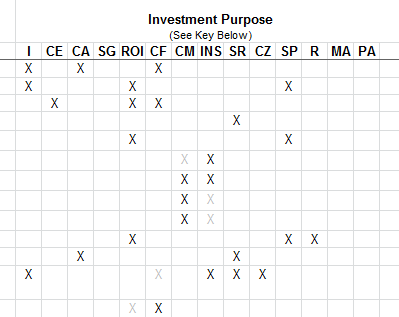

One of my advisors suggested I list the reasons why Sarita and I wanted to put money into the various investments we had already purchased or that we were thinking we wanted to buy. “Maybe create a matrix that indicates your purposes for each asset,” he suggested.

I followed his counsel and found the exercise helpful and eye-opening.

(more…)

by John | Jul 2, 2016 | Success

I have run into the following questions more often than I can remember. And, most of the time, I have found them rather frustrating. How about you?

- Where do you want to be (financially) in five years? 10 years? 20 years? When you retire? Etc. (???)

- What are you aiming for in your investments: Preservation of capital? Income? Growth? Profits? Speculation? Hedging? . . .

- You’re about to buy a stock. The “best” advisors say you should know your exit strategy. Okay. So when will you know it’s time to sell?

- What’s your number (when you will know you have enough to retire)?

- Where do you want your money to go when you die?

And so forth.

Why are these questions so frustrating? Because—at least for me—I have a hard time pinning myself down! So much “depends”!

Worse, (more…)

by John | Jun 10, 2016 | Family Banking, Success

Family banking advisors1 urge us to think of money in terms of cash flow–keeping it moving–instead of cash accumulation–saving it up, storing it in savings accounts, 401(k)’s, 403(b)’s, 529 Plans, and similar “Qualified” plans.

This mentality is very different from what I was taught growing up and throughout most of my adult life.

I’m not going to try to expose the cultural messages that lead us to accumulate. That will be for a different time. What I want to point out here is the difference between cash accumulation and cash flow. (more…)

Recent Comments