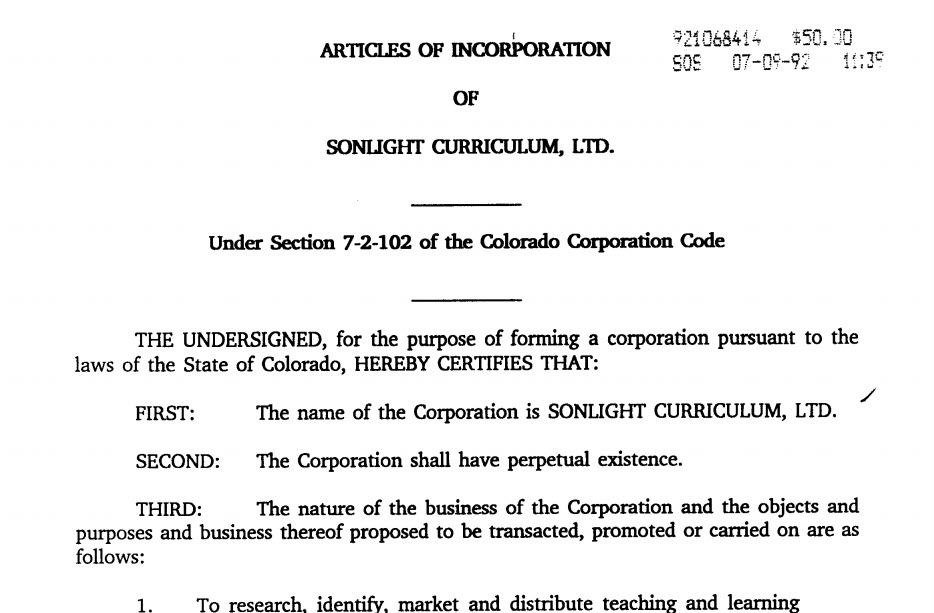

Sonlight Curriculum, Ltd.’s original Articles of Incorporation: How Sonlight Curriculum became a legal structure independent of a human being . . . and how the human beings who had created Sonlight Curriculum gained legal independence from the business!

It was 1992. We were just at the point where we were going to hire our first employee and Pete Smit urged me to call a certain company to see if maybe we wanted to engage in employee leasing rather than (all we knew about at the time) actually hiring someone.

He had given me the name of the leasing company. But, when I looked them up, it turned out (what I didn’t notice) that there was another company with virtually the same name right in front of theirs in the phone book. And I called the wrong number.

As it turned out, that was a wonderful mistake I made!

I bumped into a highly competent accountant/bookkeeper who was willing to coach us in how to run our business better than we had been running it.

And one of the first things he urged me to do was talk to an attorney about incorporation.

“ ‘Incorporation’?” I asked.

“Yes!”

“What do you mean?”

Obviously, I had heard of corporations before. But I had no idea what it meant to incorporate . . . or why one would ever want to consider doing such a thing.

Blaine, my mentor, was very patient with me.

“You fill out some papers and sign them, and you find yourself working under completely different rules.”

I had no idea what he was talking about. But I soon found out.

Limited Liability

“First benefit of incorporating: it limits your liability.”

“Sorry. I don’t understand.”

“So suppose your employee is out driving on company business,” said Blaine. (Yes. I could imagine that. Someone had to deliver checks to the bank and packages to the post office.)

“And suppose she gets in an accident where someone gets hurt. . . .

“Guess what? It doesn’t matter whether she was at fault. It doesn’t matter whether she’s the one who is hurt or someone else is hurt. In any situation like that, the attorneys are always going to look for the deep pockets.

“And who are they going to go after? Probably you.

“And if you are a sole proprietor (as we were at the time), guess what? They’re going to come after you personally. They’re going ti come after everything you own.

“On the other hand, if you sign a few papers and turn your company into a corporation, you get out of jail semi-free. They can only get at the assets that are inside the corporation. They can’t go after you. They can’t go after your home or your savings account or anything else you may own.

“That’s what ‘limited liability’ means. The corporation limits your liability.”

It was an astonishing revelation. I had never thought about what it meant when I saw all these companies whose names were followed by “Inc.” or “Corp.” or any of a number of different designations.

But it certainly made sense that we might want to incorporate if it could protect us from major lawsuits!

“But, Blaine! You’re saying we can get all these benefits simply by signing a few papers?”

“Pretty much,” he said. “Yes. . . . There are a few more rules you have to follow. But to get started, yes. Pretty much, all you have to do is sign a few papers. And then you’re protected.”

I was astonished.

Tax Benefits

Besides limiting our liability, Blaine said, we could gain some pretty amazing tax benefits, too. We could deduct or completely write off—as legitimate business expenses—certain things that, as long as we remained sole proprietors, we could not. Our health care expenses, for example. (You have to follow the specific rules. But by owning a corporation, you have that option. If you don’t, you can’t.)

Blaine and the attorney we worked with at that time (like the CPA who took over for Blaine and the attorney we worked with six years later) never discussed with us the fact that there was more than one way to create a corporation. Perhaps they simply “knew” that the C-corporation really was the best legal structure for us at the time. Or perhaps they couldn’t know for sure, but maybe they didn’t want to confuse us with the intricacies.

For whatever reason, that is what they created for us: a C-corporation. And for some reason—primarily, I think, because I was trying to sound more “international,” and partially because I really liked the feel of it—we adopted “Ltd.” as our corporate designation: Sonlight Curriculum, Ltd.

Care and Feeding of a Legal Entity

You have already heard me refer to corporations as legal structures. They are also called legal entities.

They are strange creatures, these structures or entities. They are legal creatures. Creatures of the law. They are strictly conceptual; they exist on paper. And, yet, they are real. And to keep them alive, you have to follow certain rules.

One of the first things Blaine urged upon us was to remember that we—John and Sarita—were not, never were, and never would be, the same as the company. “The company is totally separate from you.”

Sign in Your Legal Capacity

When we signed any document in the name of the company, he urged us, we had to—had to, always, every time—sign in our legal capacity vis-à-vis the corporation. Sarita Holzmann, President. John A. Holzmann, Secretary/Treasurer.

We were never to sign in our individual personhood: Sarita Holzmann, or John A. Holzmann.

That would open the way for us to be held personally liable for whatever we had signed in behalf of the company. The company’s protections would disappear. An opposing attorney would “pierce the corporate veil” [chain mail armor?] and get right to us.

Do Not Mingle Corporate and Personal Finances

Oh my goodness! This was a huge one from Blaine’s perspective!

“I have seen it happen far too often: a business owner mingles his personal money with corporate money, borrows from the company and never pays back. Doesn’t keep any records . . . or keeps wholly inadequate records.

“You have to hold the corporation completely at arm’s length. Never confuse your interests with the company’s interests, or the company’s interests with your interests. They must be kept completely separate.”

I was grateful for Blaine’s admonition, but it wasn’t any different from what we had been doing all along. We had always known, somehow, innately, that Sonlight was our company, but it was wholly separate from us as people.

Maybe it helped that, even when the company was a sole prop, Sarita had recorded all transactions on a (paper!) spreadsheet. And all of our transactions involved paper checks (or, sometime later, credit cards). We never received cash. And we never paid with cash. So everything had to take place through a bank account. And the bank account was in the name of the company. We had created a Sonlight Curriculum account when we first went into business. Now we had to open a Sonlight Curriculum, Ltd. bank account.

Always Pay Your Taxes!

What do I need to say?

Again, Blaine told us the stories of business owners who tried to “borrow” from the government by failing to pay their taxes: holding employees’ FICA or SUTA or other tax payments to cover corporate liabilities in other areas. “That doesn’t work!”

We understood.

And, finally:

Fulfill All the Corporate Formalities—Especially in Terms of Corporate Shareholders’ and Directors’ Meetings, Record-Keeping and State-Mandated Reporting Requirements

The reality: to some degree, especially when you are starting out, these kinds of formalities may seem far more “pro-forma”—merely “things you have to do,” “going through the motions.” They seem as if they make absolutely no difference to the company itself.

Indeed, our attorney at the time encouraged us in such a view when he urged us to record the absolute minimum in our annual meeting minutes. He would use the same basic meeting agenda/outline year after year and simply change the names or numbers if and as such changes were necessary.

But as our company has matured, and especially as we are moving toward second-generation involvement, we are finding it more and more important to keep more thorough records.

As our most recent attorney has commented, “Your meeting minutes are—or should be—your corporate memory.”

And, now that we are 26-some years into our company’s existence, and we are trying to help our children understand how to run the business, I have to confess: I wish we had kept better notes, more complete records, in the earlier years.

They really weren’ t necessary (from a legal perspective), but I sure wish we had them today!

Recent Comments